Winkle makes the securitization of accounts receivable and consumer assets less complex, more cost-effective and efficient, enabling clients to finance at rates well below their corporate rating equivalent. Our extensive reporting capabilities provide significant comfort to investors, enabling clients to maximize the advance rate against their receivables portfolio.

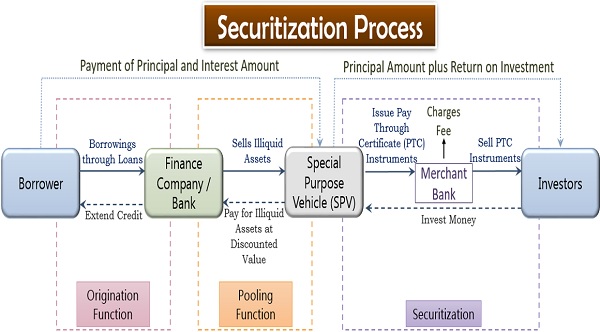

Securitization is a mechanism for companies to raise capital against portfolios of specific receivables on a non-recourse basis. Transactions typically involve a one-off or periodic legal true sale of the receivables to a Special Purpose Vehicle (“SPV”). The SPV, in turn, raises funds for a portion of the total value of the receivables, using the receivables as collateral. The seller receives the proceeds raised by the SPV initially, with the balance payable as the receivables collect.

1. Receivables / Product

In the ordinary course of business, the originator sells products and services to customers, creating receivables that are available for financing.

2. Receivables

At the inception of the transaction, the originator sells the receivables to a bankruptcy-remote Special Purpose Vehicle (“SPV”). This may be a one-off true sale, or a true sale on a revolving basis as new receivables are created.

3. Note

The SPV raises funds against the receivables by issuing a funding note (“Note”) or selling the receivables to a 3rd party funding source. The funding source may be a bank, an ABCP conduit sponsored by a bank, or a fixed income lender.

4. Note Proceeds

The proceeds of the Note are passed to the SPV.

5. Note Proceeds

The proceeds of the Note are delivered to the originator as the initial purchase price for the receivables. The balance of the purchase price will be paid as the receivables collect.

6. Payments / Collections

Payments from customers are transferred daily to the remittance account in the name of the SPV. If the Note is over-collateralized, some of these collections may be passed to the originator.

7. Receivables Transaction Data / Reports

The originator will provide daily data to Winkle Capital on the activity of the receivables portfolio.

8. Distribution instructions

Winkle Capital will produce detailed reports on receivables performance on a daily, weekly and/or monthly basis. Principal and interest on the Note is typically paid on a monthly basis.

Calculating The Advance Rate – Step 1

Transactions are typically structured to the equivalent of a high investment grade rating using methodologies recommended by the major rating agencies. The objective is to use the rating agency methodology to arrive at an advance amount or “borrowing base” for the program, taking into account the characteristics of the receivables portfolio.

First, the securitization process involves the “filtering” of a receivables portfolio through a series of eligibility criteria and concentration limits to determine which receivables are eligible for funding through the program.

Those receivables that fall outside the eligibility criteria and agreed concentration limits are deemed “non-collateral” and are not given credit in the borrowing base.

Calculating The Advance Rate – Step 2

After determining the amount of Eligible Receivables in the portfolio, rating agency methodology is used to calculate the advance amount, or borrowing base. To arrive at an investment grade equivalent rating, the methodology requires that specific amounts of Eligible Receivables are reserved to take into account the specific characteristics of the portfolio.

First, a Dilution Reserve is calculated based on historic dilution, or non-cash reductions in the portfolio e.g. credit notes. Second, a Loss Reserve is calculated based on the historic aging and losses in the portfolio. Finally, a Yield and Fee Reserve is calculated to ensure that yield and fees would be covered in any amortization of the transaction.