What is a Letter of Credit?

A letter of credit (LC) is a written document presented by the importer’s bank on the importer’s behalf. Through its issuance, the exporter is assured that the issuing bank will make a payment to the exporter for the international trade conducted. The importer is the applicant of the LC, while the exporter is the beneficiary. In an LC, the issuing bank promises to pay the mentioned amount as per the agreed timeline and against specified documents.

A guiding principle of an LC is that the issuing bank will make the payment based solely on the documents presented, and they are not required to physically ensure the shipping of the goods. If the documents presented are in accord with the terms and conditions of the LC, the bank has no reason to deny the payment.

How does Letter of Credit Work?

LC is an arrangement whereby the issuing bank can act on the request and instruction of the applicant (importer) or on their own behalf. Under an LC arrangement, the issuing bank can make a payment to (or to the order of) the beneficiary (that is, the exporter). Alternatively, the issuing bank can accept the bills of exchange or draft that are drawn by the exporter. The issuing bank can also authorize advising or nominated banks to pay or accept bills of exchange.

Fee and charges payable for an LC

There are various fees and reimbursements involved when it comes to LC. The fees charged by banks may include:

- Opening charges, including the commitment fees, charged upfront, and the usance fee that is charged for the agreed tenure of the LC.

- Retirement charges are payable at the end of the LC period. They include an advising fee charged by the advising bank, reimbursements payable by the applicant to the bank against foreign law-related obligations, the confirming bank’s fee, and bank charges payable to the issuing bank.

Parties involved in an LC

Apart from the applicant, the beneficiary, and the issuing bank, other parties involved in an LC arrangement include the advising bank, confirming bank, negotiating bank, reimbursing bank, and the second beneficiary.

- The advising bank is responsible for the transfer of documents to the issuing bank on behalf of the exporter and is generally located in the country of the exporter.

- The confirming bank provides an additional guarantee to the undertaking of the issuing bank. It comes into the picture when the exporter is not satisfied with the assurance of the issuing bank.

- The negotiating bank negotiates the documents related to the LC submitted by the exporter. It makes payments to the exporter, subject to the completeness of the documents, and claims reimbursement under the credit.

- The reimbursing bank is where the paying account is set up by the issuing bank. The reimbursing bank honors the claim that settles the negotiation/acceptance/payment coming in through the negotiating bank.

- The second beneficiary is one who can represent the original beneficiary in their absence. In such an eventuality, the exporter’s credit gets transferred to the second beneficiary, subject to the terms of the transfer.

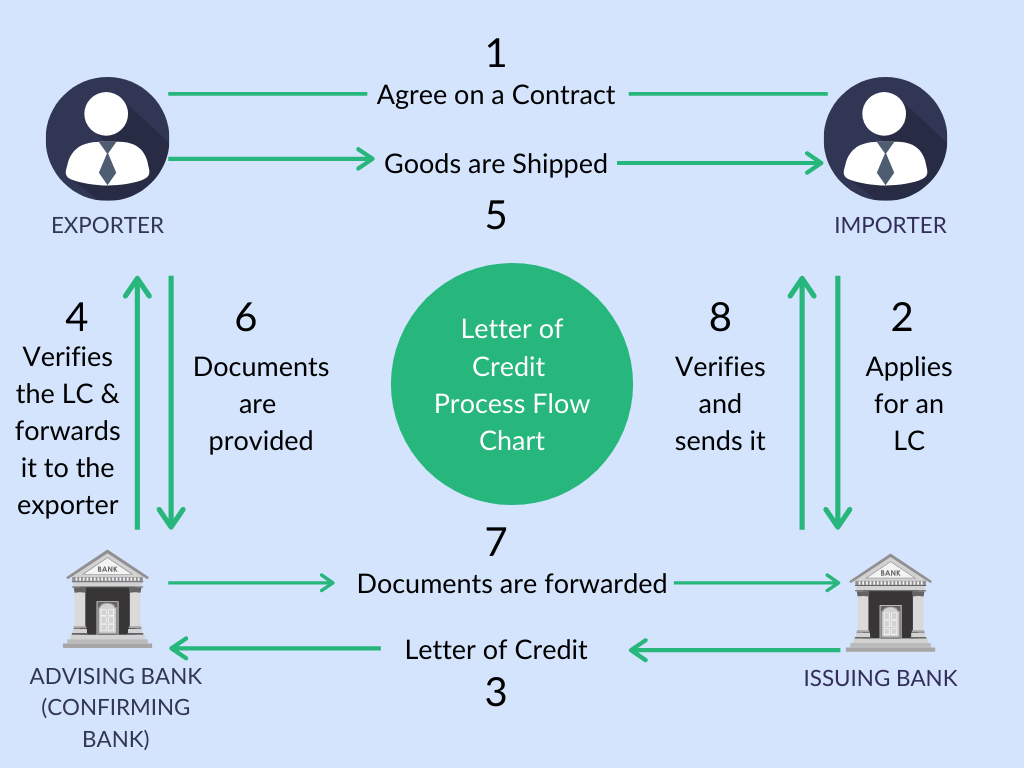

Letter of Credit – Process

The entire process under LC consists of four primary steps:

Step 1 – Issuance of LC

After the parties to the trade agree on the contract and the use of LC, the importer applies to the issuing bank to issue an LC in favor of the exporter. The LC is sent by the issuing bank to the advising bank. The latter is generally based in the exporter’s country and may even be the exporter’s bank. The advising bank (confirming bank) verifies the authenticity of the LC and forwards it to the exporter.

Step 2 – Shipping of goods

After receipt of the LC, the exporter is expected to verify the same to their satisfaction and initiate the goods shipping process.

Step 3 – Providing Documents to the confirming bank

After the goods are shipped, the exporter (either on their own or through the freight forwarder) presents the documents to the advising/confirming bank.

Step 4 – Settlement of payment from importer and possession of goods

The bank, in turn, sends them to the issuing bank and the amount is paid, accepted, or negotiated, as the case may be. The issuing bank verifies the documents and obtains payment from the importer. It sends the documents to the importer, who uses them to get possession of the shipped goods.

The following process flow chart is an example of how letter of credit procedure works:

Types of Letter of Credit

The following are the commonly used types of LC:

Revocable Letter of Credit

Revocable LC can be modified or revoked independently by the issuing bank without any notice. It is rarely practiced in modern-day international trade.

Irrevocable Letter of Credit

Irrevocable LC cannot be revoked or modified without the consent of the issuing bank, the beneficiary, and the confirming bank. It is a safer option for the exporter as it assures that the amount mentioned in the LC will be paid if the submitted papers fulfill the terms and conditions of the agreement.

Confirmed Letter of Credit

Confirmed LC is an arrangement where another bank adds its guarantee to the LC. It gives added assurance to the exporter, but the cost of the LC also escalates.

LC at Sight

Sight Credit LC requires the issuing bank to make the payment at sight, on-demand, or upon presentation.

Usance Letter of Credit

Usance Credit LC is where the draft is drawn on the issuing or corresponding bank at the end of the agreed usance period.

Back to Back LC

Back-to-back Letter of Credit is where a second LC is opened with another LC as security. This second LC finances both sides of a transaction through credit and counter-credit. A middleman buying from one party and selling to another is a typical case of back-to-back LC.

Transferable Letter of Credit

Transferable LC is used when there is a middleman involved or where a company sells the product of another company/producer. The first beneficiary requests the bank to transfer the entire payment or part thereof to the second beneficiary. In this arrangement, the first beneficiary is generally the middlemen or a company who sells another’s products.

Standby Letter of Credit

Standby LC is similar to a bank guarantee and is more popular in the US. The exporter can obtain payment from the bank even in the case of the applicant’s failure to perform as per the agreement.

Freely Negotiable Letter of Credit

Freely Negotiable LC allows any bank to become a nominated bank as long as it is willing to pay, accept, incur deferred payment undertaking, or negotiate the LC. The LC has to indicate that it is not restricted to any bank for negotiation or that it can be negotiated in any bank.

Revolving Letter of Credit

Revolving LC is one where the amount mentioned gets reinstated after payment, reducing the need to create a new LC. It is used in case of shipments with a diverse set of goods or repeated set of the same goods, which are traded within a specific period.

Difference between Letter of Credit and Bank Guarantee

A Letter of Credit is a commitment document. It is an assurance given by the bank or any other financial institution for a performing activity. It guarantees that the payment will be made by the importer subjected to conditions mentioned in the LC. There are 4 parties involved in the letter of credit i.e the exporter, the importer, issuing bank and the advising bank (confirming bank).

Whereas, a Bank guarantee is a commercial instrument. It is an assurance given by the bank for a non-performing activity. If any activity fails, the bank guarantees to pay the dues. There are 3 parties involved in the bank guarantee process i.e the applicant, the beneficiary and the banker.

Things to consider before getting an LC

A key point that exporters need to remind themselves of is the need to submit documents in strict compliance with the terms and conditions of the LC. Any sort of non-adherence with the LC can lead to non-payment or delay and disputes in payment.

The issuing bank should be a bank of robust reputation and have the strength and stability to honor the LC when required.

Another point that must be clarified before availing of an LC is to settle the responsibility of cost-bearing. Allotting costs to the exporter will escalate the cost of recovery. The cost of an LC is often more than that of other modes of export payment. So, apart from the allotment of costs, the cost-benefit of an LC compared to other options must also be considered.

The companies you do business with, undoubtedly have impeccable credentials. But why take a chance? Winkle Capital, with its associate banks, offers Letter of Credit (LC) facilities which arms you with guarantee of payment – especially useful while transacting with companies you have had limited exposure to and also for importing your capital goods from any part of the world. We offer two types of letter of credit – Sight and Usance LCs, both inland and foreign.

Considering the dynamic nature of international dealings like distance and differing laws, the use of letters of credit has become a critical aspect of international trade. Our Letter of Credit will provide you with the highest security and minimize your credit risk. Winkle Capital’s Letter of Credit gets sanctioned and issued quickly, and is competitively priced.

Winkle Capital Advantage:

Offers two types of Letters of Credit: Sight & Usance LC, both inland & foreign

Tie ups with large global OEMS

Structuring of financing solutions in foreign currency at LIBOR rates to avail extended credit against the Letters of Credit

Financing up to 100% of LC value

Convenience of payment as per LC terms

LIBOR based pricing upto 3 Years

Quicker approvals

No Extra Collateral